Let’s face it. Late payments are a huge headache for construction companies.

A recent study by the Australian government found that 72% of subcontractors were paid late on 40% of the invoices they sent out. Given the scale of the problem, the importance of enforcing well-formulated and professional payment terms cannot be overstated. The right contractor payment terms help companies to get their money promptly and on time. With that in mind, this article covers everything you need to know about contractors’ payment terms.

Read on to follow through with practices that guarantee the accuracy of payment terms and help you receive your hard-earned money on time!

First, let’s throw more light on what exactly payment terms and conditions are. How can they help you grow your contracting business?

Payment terms outline how, when, and by what method your clients should pay for your services.

These terms can also include additional information, such as:

As strange as it may sound, some construction contracts make no mention of payment terms, which causes many issues afterward.

The key reason for defining payment terms is to ensure you receive scheduled payments on time from the client. Negotiating the payment with the client beforehand is essential. This will ensure that both sides can plan their budgets and activities accordingly.

Another key reason is safety. You get peace of mind knowing you have legal protection in case your client fails to pay you on time. Once you agree upon payment conditions, include them in your client contract in every detail.

Defining these terms and conditions can also help you estimate your cash flow. Knowing when and how much money you will have on hand allows you to make important financial decisions beforehand.

And most importantly, having clear contractor payment terms minimizes confusion and sets the bar for future expectations. When both parties know what to expect and when to expect it, there is no room for misunderstandings.

Much like the construction project itself, the terms of payment are the result of collaboration between two parties. Though contractors might have their preferred payment terms, they should also consider the client’s convenience, the scope of the project, and many other factors to set terms that are convenient for all stakeholders.

Now, let’s look at how to set contractor payment terms that will protect you in all situations!

Hardly anyone likes to read every detail of long and wordy contracts. Especially if nothing is disputed during the project, exploring the terms of payment in advance may not seem to matter much. It’s only when we run into too much back-and-forth and disagreements during a project that the importance of the terms and conditions – predefined and agreed upon beforehand – is acknowledged.

Particularly in such a complex field as construction, with projects that cost hundreds of thousands and often millions of dollars, defining payment terms upfront is an absolute must.

Before you sign a contract, make sure to go through the agreement in detail to ensure everything is clear, and the contract protects you in every possible scenario when your payment is at risk.

Also, be certain to include clauses in the contract that cover dispute resolutions and a provision for additional work and variations, should they occur.

When it comes to defining the payment terms beforehand, it’s also of utmost importance to review them in a timely manner and if needed to make the necessary adjustments and always keep them up to date.

The payment schedule should include all of the information you need to plan out anticipated payments, such as:

• The contract start date

• Initial payment amount (downpayment)

• Scheduled intervals for subsequent payments

• Project completion timeframe

• The estimated total amount for construction

A simple time-based schedule for a home remodel at $160,000 may look like this:

Down Payment: $5,000

Week 2 Progress Payment: $36,800

Week 4 Progress Payment: $36,800

Week 6 Progress Payment: $36,800

Week 8 Progress Payment: $36,800

Final Payment for Job Completion: $7,800

These details can serve as a general guide for budgeting and resource allocation during the project, and are important for delivering a project without cash flow issues.

However, even with a careful formulation of payment terms in your construction contract, the client may still not adhere to payment deadlines.

To keep client within the limits of the payment schedule, here are some proven methods you can adopt.

To be prepared for such cases, you can add a late penalty clause in the contract. It’s mostly acceptable to charge a penalty fee of 1-3% every week if a payment is late. On the other hand, you can offer your clients an early payment discount to motivate them to pay on time. For example, you could offer a 10% discount if the client pays within 20 days instead of 30. An effective and easy strategy for payment collection is to set up friendly reminders for due payments.

Having a consistent invoice reminder procedure in place for your construction company can go a long way to ensuring steady cash flow.

Another key point to consider is negotiating shorter payment periods. The duration of the invoice payments may vary according to your business structure, from 10-15 days to 90 days.

Finally, a mechanics lien is a construction company’s most powerful tool to ensure they get paid on time. It gives contractors the legal right to place a lien on the property if they aren’t paid.

Check out more here: How to File a Mechanics Lien

Including multiple payment methods in a contract and allowing clients to choose the one that’s most convenient for them increases the likelihood of receiving money on time.

Among the most efficient and fastest forms of payment nowadays are mobile and online payments (like PayPal). Allowing clients to pay with credit cards (Visa, Mastercard, American Express) and debit cards or bank transfers directly on invoices are progressive payment techniques to consider.

They are easy to use for both parties in a contract, give extra financial flexibility, and keep a record of all the transactions between you and your client. You can accept online payments through a merchant service provider and choose a merchant service that can integrate with your invoicing software.

Above all, never put off invoicing. Delays in invoicing can result in late payments or cash flow interruptions; both are things you should try to avoid. Many clients have fixed dates for paying invoices. Scheduling a due date that is nearer to such dates can ensure prompt payments.

Invoicing software solutions like Bulidern can help you streamline your invoicing process and ensure on-time payments. Learn more about this.

Set a construction payment schedule that documents a timeline throughout the whole project and identifies when your clients will need to make money transfers to you. If you haven’t had such an experience before, here are some payment schedules that are proven to work in the construction industry.

A prepayment is when the client pays you some amount of money in advance before you deliver the service. Some companies ask for an upfront payment as a small percentage of the overall payment. Somewhere between 25 to 33% is a reasonable expectation for medium-size projects. Sometimes such an upfront payment becomes crucial for construction company owners, to have some money in advance for their service to pay for the initial project costs.

However, as with any financial transaction made in expectation of work being carried out, there is a risk. The main problem is the possibility that the work will not be completed, either because the contractor is unable to do it satisfactorily, or in the worst-case scenario, ceases to trade.

Net payment is the most common payment schedule for medium-sized construction companies. This payment term refers to the number of days – 10, 30, or 60 days – within which an owner should pay an invoice after it has been received.

10, 30, and 60 are the most accepted net payment terms in the market, but that doesn’t mean you can’t set your own net days.

Just make sure your set schedule is acceptable and approved by your client beforehand.

The 2/10 net 30 principle represents an agreement that the client will receive a 2% discount on the net invoice if they pay within 10 days.

Otherwise, the full invoice amount is due within 30 days.

With this schedule, contractors get a quicker-than-usual injection of working capital they can put to good use immediately, while clients can capture a risk-free return on investment through the discounted invoice.

The following example shows the impact it can have.

Invoice amount: $100,000

Invoice date: 09/01/2022

Invoice due date: 30 days (09/30/2022)

Paying within 10 days will result in a 2% discount: $98,000.

Paying after 10 days but before or on the due date means the invoice will be paid in full at $100,000.

Due to its mutual benefit on offer, this payment term is one of the most popular approaches to early payment discounts that motivates clients to pay on time.

Cash on delivery (COD) represents any payment from the owner once they receive a certain milestone from the pre-agreed construction project.

With this schedule, you can greatly shorten the days receivable for a business.

If you want to use this term often, it is helpful to have many avenues for payment such as credit card and EFTPOS facilities.

A client’s responsibility to pay an invoice by the month’s end is referred to as the end of the month (EOM) payment.

So if you receive an invoice dated January 21, your payment is due by January 31.

This has the advantage of ensuring a relatively predictable receipt of funds at the end of each month.

You might also employ a net 5 EOM, which requires the client to pay within five days following the EOM.

A well-defined set of payment terms should include enough detail to ensure all project stakeholders are informed and aware of the pre-defined payment schedule. It should contain the following elements:

It’s an easy oversight to make, but without the proper information-legal names, addresses, and appropriate signatures on all required documents, a contract is not legally binding even if it’s signed.

In some cases, it’s also essential for builders to include their license number in the contract.

The scope of work might be the most important part of the construction contract, as it defines all the objectives and requirements of the project. This area of the contract should, in great detail, explain the services to be provided, including a description of materials, quality, schedule of work, and other specifications pertinent to the construction.

Overall, the scope of work should lay out the owner’s expectations for the completed project.

Establishing a payment schedule and a timeline of the payments to be made throughout the lifetime of the project is essential in any construction contract. These schedules help clients know when and how much they need to pay the contractor.

Clearly stating the total cost of services listed in the contract and anything beyond its scope is of utmost importance. The contract should also define which payment methods are acceptable for you (bank account, PayPal, Google Pay, etc.).

Finally, outlining who from the parties in the contract has the authority to make and finalize decisions during the construction project will help to avoid disputes. With so many moving parts, this simple element in the contract can save a lot of headaches and confusion.

Even after setting up payment terms and schedules, keeping up with deadlines will not be easy when you work on multiple projects. While it may seem challenging to stay on top of different deadlines, doing it is essential to ensure you get paid in a timely manner.

As a contractor, you can effectively manage payment processes by using a single software – Buildern!

Let’s have a closer look at the financial tools of the Buildern construction management platform that can help you save time, streamline payment processes, and increase company revenue!

Invoices provide flexible solutions to help you maintain cash flow throughout the different phases of each build. With Buildern you can set up progress billing for regularly scheduled payments tied to project milestones.

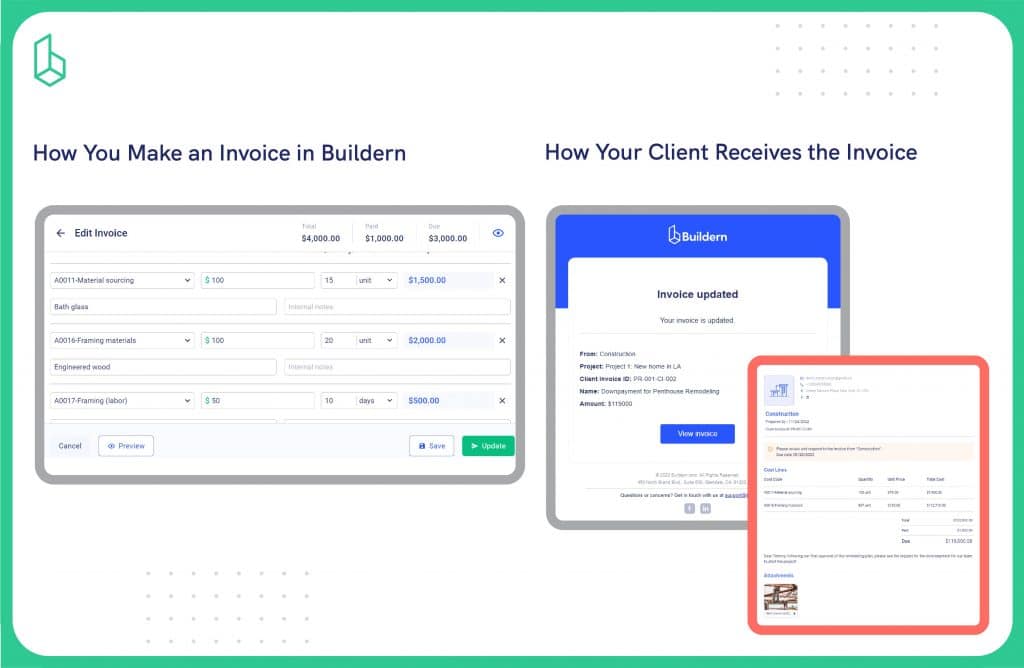

Luckily for you, with Buildern there is no need to deal with complex formatting to make your invoice look professional. Just fill in the details inside your invoicing dashboard and the software will adjust it to the accepted industry standards.

Log in to Buildern, and choose “Invoices” from the left menu to get a ready-made template to fill in and send to your clients.

Once you have created your invoice and checked every detail, send it to your client from Buildern’s dashboard.

The client will instantly receive an email with the link to the invoice. The letter will contain detailed notes on the invoice amount, due date, and other information about the job. Meanwhile, once the client sees the invoice, Buildern will automatically change the invoice status to “viewed”.

Buildern securely keeps all the construction invoices in your account. To manage your sent invoices, head to “Client Invoices” on the left-side menu. Here you can see the list of all your invoices, filter them by status, sort by dates and search for a specific invoice or client. Once you receive the payment for the specific invoice, record it inside that invoice by pressing “Record Payment” at the bottom of the page. That way, you will have a clear picture of all your payments and their status.

Generally, the contractor payment terms spell out how and when your clients make payments to your company.

Clearly communicating all payment details to your clients beforehand will ensure everyone is on the same page. This in its turn helps them build better professional relationships and get the money on time.

Other than that, integrating professional solutions like Buildern can help you accurately track and request your construction payments. From issuing invoices to tracking payments on multiple construction projects, Buildern can help you collect all your payments on time.