The Puerto Rico Oversight, Management, and Economic Stability Act of 2016 (PROMESA) enables Puerto Rico to restructure its debt and achieve fiscal responsibility.

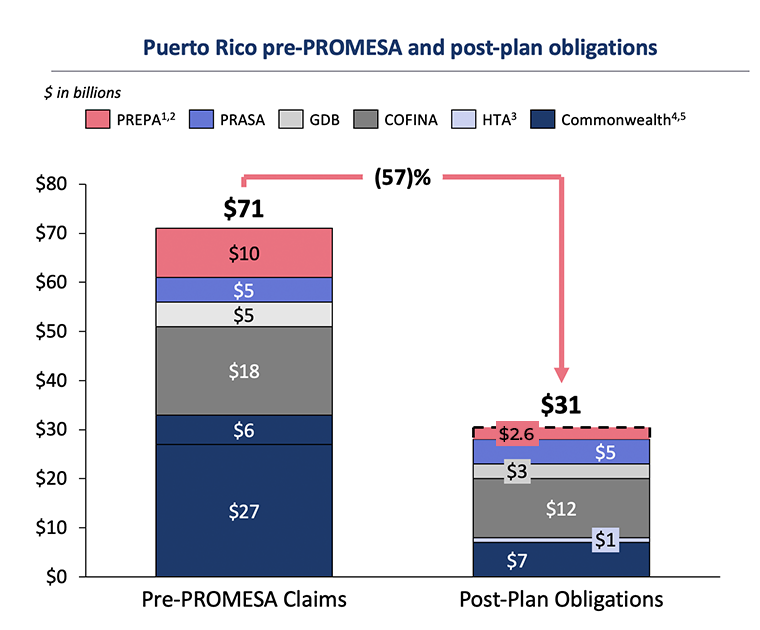

When PROMESA was enacted, Puerto Rico faced an unsustainable burden of more than $70 billion in debt and more than $55 billion in unfunded pension liabilities with no legal path to restructure its liabilities and stabilize its finances. Puerto Rico had lost access to capital markets.

The Oversight Board represents Puerto Rico in the debt restructuring process and negotiates with one overarching goal: to reach consensual agreements in the best interest of all stakeholders that will end Puerto Rico’s bankruptcy under PROMESA.

The Oversight Board, together with the Government of Puerto Rico, so far restructured about 80% of Puerto Rico’s outstanding debt, lowering total liabilities from more than $70 billion to a sustainable $37 billion, which will save Puerto Rico more than $50 billion in debt service payments. The debt restructuring process continues.

For copies of the documents filed in the Title III cases, please visit https://cases.ra.kroll.com/puertorico. Copies of the documents are also available by calling +1 (844) 822-9231

On January 18, 2022, Judge Laura Taylor Swain of the U.S. District Court for the District of Puerto Rico confirmed the Plan of Adjustment for the Commonwealth of Puerto Rico to restructure $33 billion of liabilities against the Commonwealth of Puerto Rico, the Public Building Authority (PBA), and the Employee Retirement System (ERS); and more than $55 billion of pension liabilities to sustainable $7 billion. The Plan of Adjustment became effective on March 15, 2022, concluding a major chapter in the largest public sector bankruptcy in U.S. history.

On October 12, 2022, Judge Laura Taylor Swain of the U.S. District Court for the District of Puerto Rico confirmed the Plan of Adjustment for the Puerto Rico Highway and Transportation Authority (HTA).

The Plan became effective on December 6, 2022. It reduced HTA’s $6.4 billion in claims by more than 80% and saves Puerto Rico more than $3 billion in debt service payments.

The Plan of Adjustment creates a solid financial foundation to ensure Puerto Rico’s roads and public transportation system are maintained and improved. HTA will now be able to implement the transportation sector reforms set forth in the certified HTA and Commonwealth Fiscal Plans.

The Oversight Board continues to work on completing the restructuring of PREPA’s debt. Ending PREPA’s bankruptcy is a key factor in Puerto Rico’s economic success.

On December 16, 2022, the Oversight Board filed its proposed Plan of Adjustment to restructure more than $10 billion of debt and other claims against the Puerto Rico Electric Power Authority (PREPA) with the U.S. District Court for the District of Puerto Rico. The proposed Plan, as amended, would reduce PREPA’s unsustainable debt by around 80%, to approximately $2.6 billion, excluding pension liabilities. The U.S. District Court has since directed the parties to PREPA’s debt restructuring under Title III of PROMESA to return to mediation. The Oversight Board is negotiating in good faith and in the interest of the people of Puerto Rico. PREPA’s bankruptcy held back the transformation of Puerto Rico’s energy system, and the goal of the debt restructuring is to provide the financial stability necessary to invest in a modern, resilient, and reliable energy system for Puerto Rico.

Ever since Governor Alejandro García Padilla declared Puerto Rico’s debt unpayable in 2015, Puerto Rico’s inability to pay its debt has hampered the economic recovery and affected the lives of every resident and the success of every business.

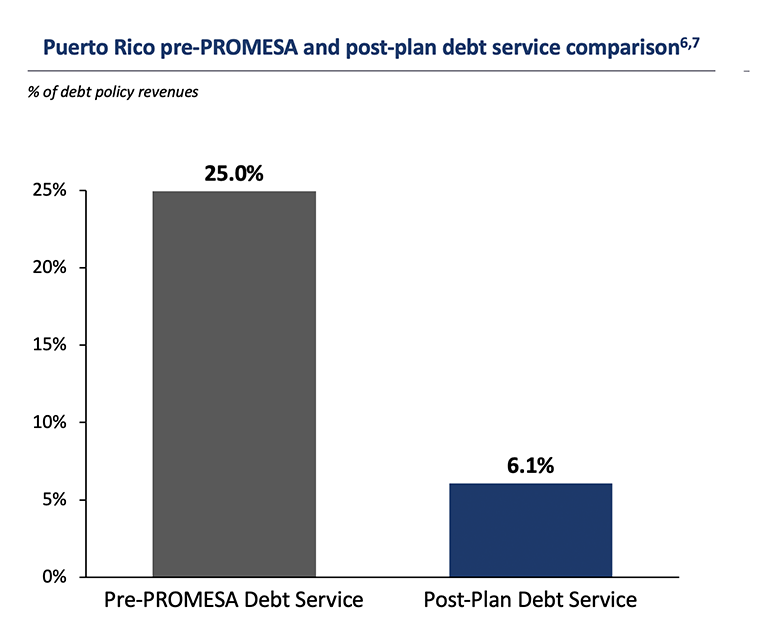

PROMESA opened a path to end this crisis. The law gives Puerto Rico an opportunity no U.S. state has: a formal process similar to municipal bankruptcy to restructure its debt to levels it can afford. The Oversight Board filed a Plan of Adjustment with the U.S. District Court for the District of Puerto Rico that reduces the debt by 80% and saves Puerto Rico more than $50 billion in debt service payments.

Puerto Rico’s debt was issued by more than a dozen public entities, ranging from the central government itself and the public employee retirement system to separate public corporations such as the Puerto Rico Electric Power Authority and the University of Puerto Rico.

More than 165,000 creditors have filed proofs of claim. Creditors range from mutual funds and hedge funds to individual residents of Puerto Rico and retirees eligible to receive a government pension, among others.

The process of resolving Puerto Rico’s fiscal crisis depends in large measure on accurate information about the size and nature of the debt. That is why the Oversight Board commissioned an investigation of the massive debt in 2017. Under section 104(o) of PROMESA, the Oversight Board was authorized to “investigate the disclosure and selling practices in connection with the purchase of bonds issues by a covered territory.” The Oversight retained the independent investigations firm Kobre & Kim LLC to conduct the investigation of the debt. In August 2018, the Oversight Board presented the more than 600-page Kobre & Kim report about the debt and factors that contributed to Puerto Rico’s fiscal crisis. Link to report.

Based on the Report, the Oversight Board, along with the Unsecured Creditors Committee challenged the legitimacy of $6 billion of Commonwealth debt in the U.S. District Court for the District of Puerto Rico. Ultimately, the issues as to the “validity” of the debt was settled with the Plan of Adjustment.

With the period of financial crisis for Puerto Rico is coming to an end, much of Puerto Rico’s economic future and sustainability are in the elected Government’s hands. Puerto Rico’s future will depend on its commitment to fiscal responsibility to create sustainable, long-term economic growth and avoid the past practice of overspending.

The Plan of Adjustment established a Debt Management Policy to prevent Puerto Rico from repeating past mistakes that led to the accumulation of its unsustainable debt.

For copies of the documents filed in the Title III cases, please visit https://cases.ra.kroll.com/puertorico. Copies of the documents are also available by calling +1 (844) 822-9231

For Press Inquiries:

Matthias Rieker – Communications Director matthias.rieker@promesa.gov

Share Your Comments with the Board

The Board welcomes your comments, ideas and information. You may do so by writing to comments@promesa.gov or fill out our contact us form. Requests to receive media releases here.

Disclaimer: All information contained in this website or accessed from websites to which this website links is provided “as is” without warranty of any kind and, in particular, no representation or warranty, express or implied, is made or is to be inferred as to the accuracy, reliability, timeliness or completeness of any such information. This website is to be used for informational purposes only and may not be relied upon for any other purpose. You may be able to link from this website to third party websites. Links to other websites do not constitute our endorsement or sponsorship of such websites or the information, content, products, services, advertising, code, or other materials presented on or through such websites. No representation is made that any statistical or numerical information is without errors or omissions which may be considered material. Under no circumstances shall the Financial Oversight and Management Board for Puerto Rico, its members, directors, officers, agents, employees, or advisors assume any responsibility or liability for the use of the information provided herein.